As Americans face record inflation, high housing costs, and rising national debt, more families and businesses are making a major life change—moving to red, tax-friendly states. The reasons go far beyond just saving money. These conservative-led states are offering a model of freedom, opportunity, and financial stability that stands in stark contrast to the burdens of high-tax blue states.

Let’s take a closer look at why tax-friendly red states are thriving—and what hidden benefits residents are discovering once they make the move.

Panaprium is independent and reader supported. If you buy something through our link, we may earn a commission. If you can, please support us on a monthly basis. It takes less than a minute to set up, and you will be making a big impact every single month. Thank you!

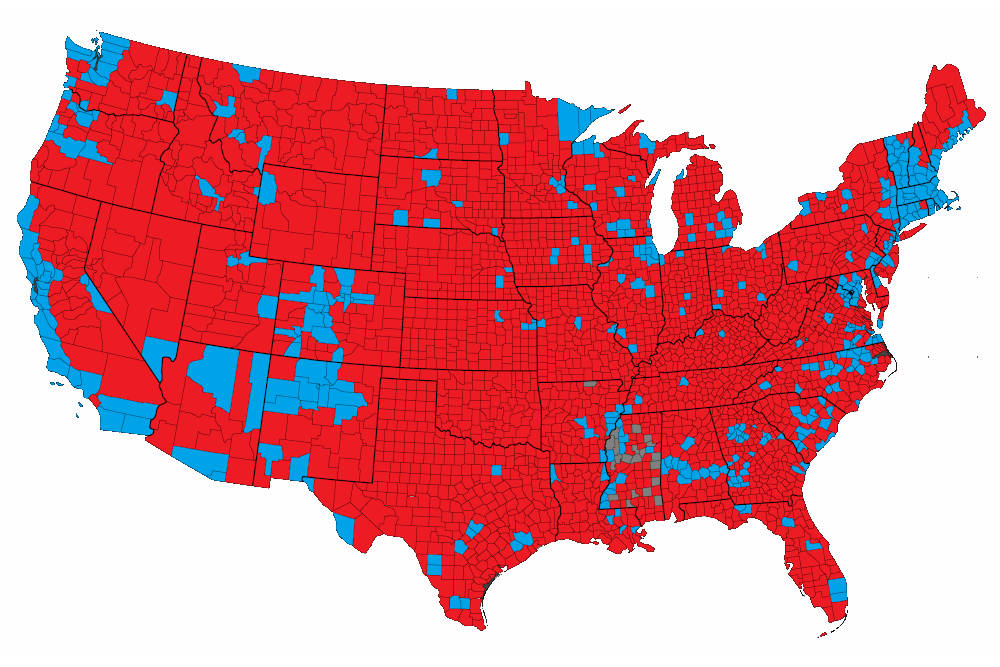

The Great Migration to Red States

The past few years have seen millions of Americans leaving blue states like California, New York, and Illinois for red states such as Texas, Florida, and Tennessee.

According to recent data, states with low or no income tax are experiencing population booms, business growth, and surging home values. Meanwhile, high-tax states are losing both residents and employers.

This migration is about more than money—it’s about freedom, opportunity, and quality of life.

The Financial Freedom Advantage

One of the clearest benefits of living in tax-friendly red states is financial freedom. Residents keep more of what they earn, allowing for greater savings, investment, and family security.

1. No State Income Tax

States like Florida, Texas, and Tennessee have eliminated state income tax altogether. This means more take-home pay for workers and higher profits for business owners.

For example:

-

A middle-class family earning $80,000 can save thousands of dollars each year compared to a similar household in New York or California.

-

Retirees can stretch their pensions and savings further without state tax burdens.

2. Lower Property and Sales Taxes

Many red states manage to keep property and sales taxes lower than blue states by prioritizing efficient governance and fiscal discipline. This helps families afford homes, vehicles, and essentials without being taxed from every angle.

3. Lower Cost of Living

A tax-friendly environment naturally leads to a lower cost of living. From housing to groceries, residents of red states spend less overall and gain more economic stability.

In short, red-state policies protect your wallet—but they also protect your ability to build a future.

The Business Boom

Tax-friendly states have become magnets for entrepreneurs and small business owners. With fewer regulatory hurdles and lower taxes, businesses can thrive, expand, and create jobs.

-

Corporate relocations from blue states to red states are accelerating.

-

Startup ecosystems in cities like Austin, Nashville, and Tampa are booming.

-

Job creation is growing faster in red states, especially in technology, manufacturing, and logistics.

This economic momentum isn’t accidental—it’s the result of conservative fiscal policies that reward innovation and productivity instead of punishing success.

Quality of Life and Family Stability

Beyond money, families in red states are discovering something deeper—a better quality of life rooted in traditional values and community strength.

Stronger Family Values

Red states tend to uphold policies that support family life, from affordable education options to community-based childcare and faith-centered initiatives.

Safe and Stable Communities

With lower crime rates, well-funded law enforcement, and respect for local authority, many conservative states offer peace of mind and safety that large liberal cities struggle to maintain.

Freedom from Overreach

Residents enjoy more freedom to make choices about healthcare, education, and personal beliefs without excessive government interference.

These cultural and social benefits make red states not just tax-friendly—but life-friendly.

Infrastructure and Growth

Conservative states aren’t just cutting taxes—they’re investing smartly in growth.

-

Infrastructure projects like new highways, ports, and broadband expansion are improving access and opportunity.

-

Housing developments are rising to meet population demands, often with fewer zoning restrictions.

-

Energy independence policies keep utility costs low while ensuring reliable power for homes and businesses.

This balanced approach of low taxes plus smart investment creates sustainable growth that benefits residents for generations.

Why Blue States Are Losing Ground

While red states thrive, blue states are struggling under the weight of high taxes and big government.

1. High Tax Burden

States like California and New York impose steep income, property, and business taxes. These policies drive out workers, investors, and entrepreneurs.

2. Mismanaged Budgets

Many blue states face large deficits despite high taxes—proof that bigger government doesn’t always mean better results.

3. Declining Public Services

Even with higher spending, residents often face poor infrastructure, rising crime, and underperforming schools.

As more people leave, blue states lose revenue, forcing even higher taxes to compensate—a vicious cycle that pushes more residents away.

The Hidden Benefits Few Talk About

The financial perks are obvious, but the hidden benefits of living in red tax-friendly states often surprise new residents:

1. Personal Empowerment

Keeping more of your income isn’t just financial—it’s psychological. People feel more control over their lives and choices.

2. Entrepreneurial Culture

Low taxes attract innovators. Many red-state residents find new opportunities to start businesses or grow careers.

3. Community Connection

Smaller government fosters stronger communities. Local organizations and neighbors often fill the role of support networks more effectively than state bureaucracies.

4. Political Representation That Reflects You

Residents in red states enjoy leadership that aligns with their values—limited government, fiscal responsibility, and individual freedom.

These subtle but powerful benefits are why so many Americans describe moving to a red state as “life-changing.”

The Real Estate Advantage

With growing migration patterns, real estate in red states is booming—but still affordable compared to coastal blue states.

-

Low property taxes and minimal regulation encourage homeownership.

-

Growing job markets keep demand for housing strong and stable.

-

Rural and suburban communities offer space, safety, and affordability.

Families seeking long-term stability find that red-state housing markets are safer investments than volatile urban centers burdened by overregulation and taxes.

Energy Freedom and Cost Stability

Energy policy plays a huge role in inflation and cost of living. Red states that prioritize energy independence—such as Texas, Oklahoma, and North Dakota—keep prices lower and supply more stable.

-

Residents benefit from affordable electricity and fuel.

-

States generate revenue without raising taxes by responsibly using natural resources.

-

Energy-sector jobs strengthen local economies and middle-class growth.

Meanwhile, blue states that prioritize expensive green mandates often pass those costs to consumers, driving prices higher and reducing competitiveness.

A Model for America’s Future

Red states are proving that low taxes and conservative principles work. They’re not only attracting residents but also setting the stage for America’s economic recovery and long-term success.

Key takeaways from their model include:

-

Fiscal Discipline: Live within means and prioritize essential spending.

-

Economic Freedom: Trust individuals and businesses to innovate.

-

Local Control: Empower communities instead of distant bureaucracies.

-

Strong Values: Family, faith, and work ethic drive prosperity.

These principles form the foundation of red states’ success—and a roadmap for the nation’s future.

Conclusion

The rise of red, tax-friendly states is one of the defining economic and cultural shifts of modern America. Families, retirees, and businesses are moving not just for lower taxes but for greater freedom, safety, and opportunity.

While blue states continue to raise taxes and expand bureaucracy, red states prove that limited government, personal responsibility, and sound fiscal policy lead to prosperity and happiness.

The evidence is clear: the future belongs to states that respect taxpayers, reward hard work, and empower citizens to live free.

Call to Action

If you’re considering a move—or simply want to protect your family’s financial future—explore the opportunities in tax-friendly red states. Support conservative leaders who fight for fiscal sanity and economic freedom.

Because in America today, the best investment isn’t just in a home—it’s in a state that believes in your right to prosper.

Was this article helpful to you? Please tell us what you liked or didn't like in the comments below.

Disclaimer: The above content do not necessarily reflect the opinions of Panaprium. Panaprium does not guarantee, vouch for or necessarily endorse any of the above content, nor is responsible for it in any manner whatsoever. Any opinions expressed here are based on personal experiences and should not be viewed as an endorsement or guarantee of specific outcomes. Political commentary should be taken with a critical perspective due to the subjective nature of politics.

About the Author: Alex Assoune

What We're Up Against

Multinational corporations overproducing cheap products in the poorest countries.

Huge factories with sweatshop-like conditions underpaying workers.

Media conglomerates promoting unethical, unsustainable products.

Bad actors encouraging overconsumption through oblivious behavior.

- - - -

Thankfully, we've got our supporters, including you.

Panaprium is funded by readers like you who want to join us in our mission to make the world entirely sustainable.

If you can, please support us on a monthly basis. It takes less than a minute to set up, and you will be making a big impact every single month. Thank you.

0 comments