That’s a really important question—and it depends on your goals, risk tolerance, and time horizon. I can’t give you personalized financial advice, but I can outline the main trade-offs so you can decide what fits you best.

Panaprium is independent and reader supported. If you buy something through our link, we may earn a commission. If you can, please support us on a monthly basis. It takes less than a minute to set up, and you will be making a big impact every single month. Thank you!

📈 Stocks

-

Pros

-

Historically reliable long-term growth (average ~7–10% annually over decades).

-

Backed by real companies with earnings, dividends, and cash flow.

-

Strong regulation and investor protections (especially in major markets like the US).

-

Easier to diversify across sectors, regions, and industries.

-

-

Cons

-

Slower potential gains compared to crypto.

-

Can still be volatile, especially in tech or growth stocks.

-

Sensitive to interest rates, inflation, and recessions.

-

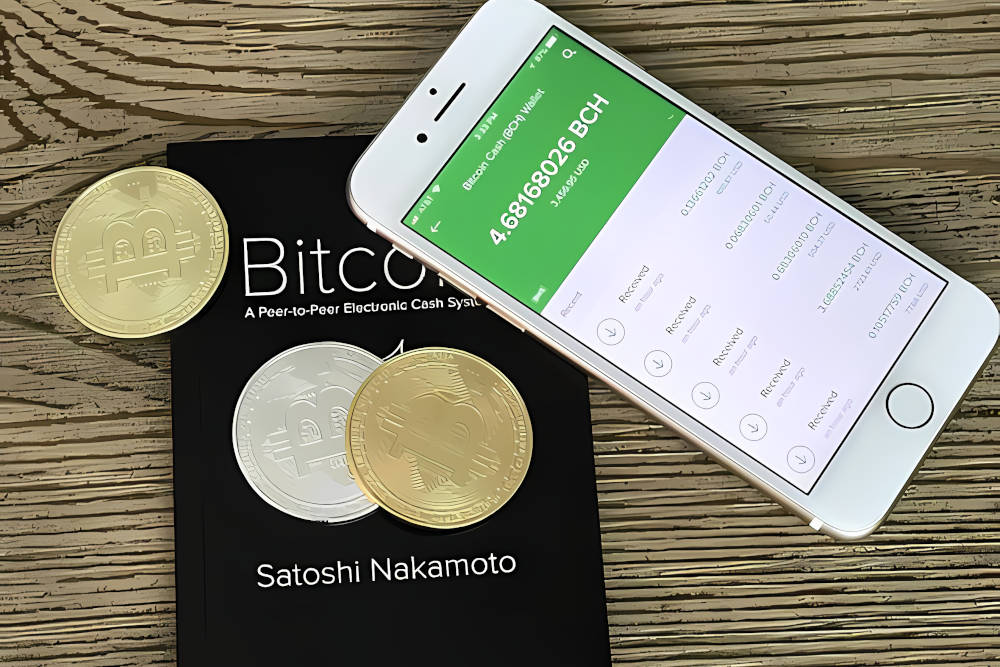

₿ Crypto

-

Pros

-

Huge upside potential—Bitcoin went from <$1,000 in 2017 to nearly $70,000 in 2021.

-

24/7 global market with high liquidity.

-

Offers exposure to new technologies (blockchain, DeFi, NFTs, Web3).

-

Some see Bitcoin as “digital gold” or a hedge against inflation.

-

-

Cons

-

Extremely volatile—prices can swing 20–50% in weeks.

-

Regulatory uncertainty (different rules in different countries).

-

Risk of hacks, scams, and exchange collapses (e.g. FTX, Mt. Gox).

-

No intrinsic earnings or cash flow (value is based on demand and belief).

-

⚖️ How People Approach It

-

Conservative investors: Focus mostly on stocks, maybe 5–10% in crypto as a speculative bet.

-

Balanced investors: Mix of stocks, bonds, and 5–20% crypto for growth potential.

-

High-risk investors: Go heavier on crypto, but accept that they might lose a big chunk.

✅ General Takeaways

-

If you want steady, long-term wealth building → stocks are safer.

-

If you want high risk, high reward speculation → crypto can play a small role.

-

A mix can make sense: stocks as your foundation, crypto as a “moonshot” bet.

Was this article helpful to you? Please tell us what you liked or didn't like in the comments below.

Disclaimer: The above content is for informational and educational purposes only and does not constitute financial or investment advice. Always do your own research and consider consulting with a licensed financial advisor or accountant before making any financial decisions. Panaprium does not guarantee, vouch for or necessarily endorse any of the above content, nor is responsible for it in any manner whatsoever. Any opinions expressed here are based on personal experiences and should not be viewed as an endorsement or guarantee of specific outcomes. Investing and financial decisions carry risks, and you should be aware of these before proceeding.

About the Author: Alex Assoune

What We're Up Against

Multinational corporations overproducing cheap products in the poorest countries.

Huge factories with sweatshop-like conditions underpaying workers.

Media conglomerates promoting unethical, unsustainable products.

Bad actors encouraging overconsumption through oblivious behavior.

- - - -

Thankfully, we've got our supporters, including you.

Panaprium is funded by readers like you who want to join us in our mission to make the world entirely sustainable.

If you can, please support us on a monthly basis. It takes less than a minute to set up, and you will be making a big impact every single month. Thank you.

0 comments