Inflation continues to dominate headlines, squeezing families, businesses, and communities across the United States. But how Americans experience and respond to rising prices varies sharply depending on whether they live in conservative or liberal states.

While blue states struggle under high taxes, heavy regulations, and federal overreach, red states are demonstrating that limited government, fiscal discipline, and market-friendly policies can ease the burden of inflation for everyday Americans.

Panaprium is independent and reader supported. If you buy something through our link, we may earn a commission. If you can, please support us on a monthly basis. It takes less than a minute to set up, and you will be making a big impact every single month. Thank you!

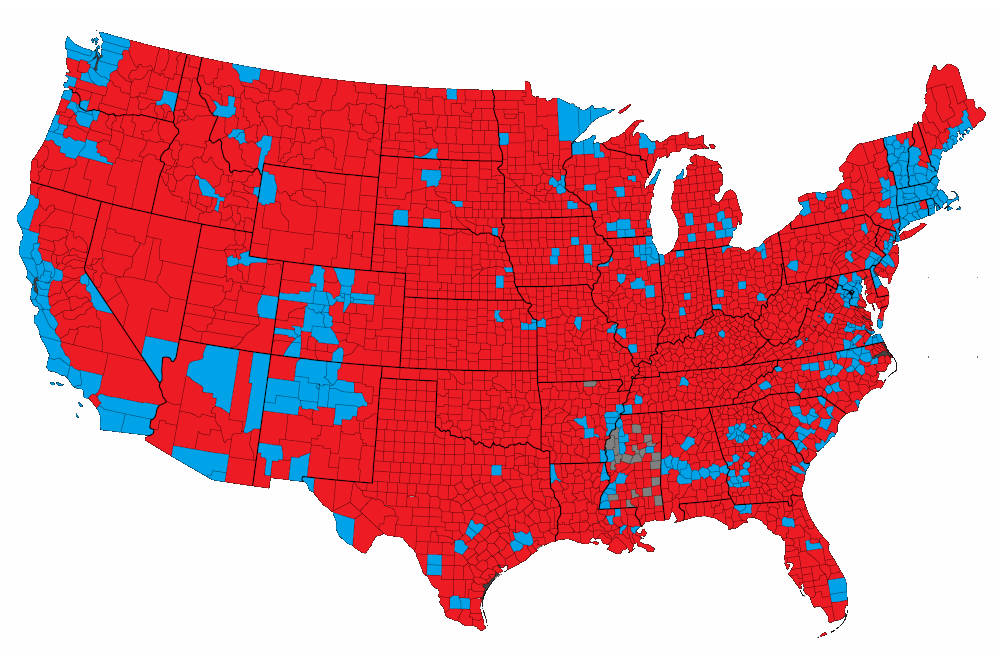

The Inflation Divide: Red States vs. Blue States

The effects of inflation are nationwide, but the impact and response differ by state political leadership.

-

Blue states: Often have higher taxes, more regulations, and stricter energy policies, which amplify inflation’s effects on households and businesses.

-

Red states: Policies favor economic freedom, lower taxes, and business-friendly environments, helping residents maintain purchasing power and adapt to rising costs.

These differences shape not only financial outcomes but also Americans’ perceptions of government, trust in leadership, and political engagement.

Why Inflation Hits Blue States Harder

1. Higher Taxes Compound Costs

States like California, New York, and Illinois impose high income and property taxes. When inflation drives up prices for goods and services, residents feel the pinch even more, reducing discretionary spending and economic mobility.

2. Strict Regulations Limit Adaptability

Heavy regulations on housing, energy, and business operations prevent fast responses to inflation. For example, rent control laws can unintentionally reduce available housing, increasing costs over time.

3. Energy and Environmental Policies

Blue states often mandate expensive renewable energy standards, raising electricity and fuel costs for families and businesses. High energy costs feed into the overall inflation experienced by residents.

4. Social Program Overhead

While generous social programs aim to protect vulnerable populations, the administration and expansion of these programs often increase state spending, requiring higher taxes that exacerbate inflation for working families.

How Red States Mitigate Inflation’s Impact

Conservative states focus on fiscal responsibility, economic freedom, and market-driven solutions, which reduce the pressure of rising prices.

-

Lower Taxes: States like Texas and Florida allow residents to keep more of their income, cushioning the impact of inflation.

-

Business-Friendly Policies: Red states promote entrepreneurship and small business growth, ensuring a competitive market that keeps prices more stable.

-

Energy Independence: States with diverse energy production, including oil and natural gas, avoid some of the supply shocks that drive prices up in high-tax, regulation-heavy states.

-

Targeted Relief Programs: Instead of sprawling federal-style programs, red states focus on efficient, needs-based support to families and businesses.

These strategies give residents more control, flexibility, and financial resilience during periods of high inflation.

Consumer Behavior Differences

Inflation affects consumer choices, but reactions differ between conservative and liberal states.

In Blue States

-

Residents often cut discretionary spending to keep up with costs, reducing demand for local businesses.

-

There’s increased reliance on government assistance programs, creating long-term dependence.

-

Many citizens express frustration and distrust toward state and federal leadership for failing to curb inflation.

In Red States

-

Consumers adjust budgets strategically without relying heavily on government aid.

-

Residents are more likely to seek entrepreneurial or side-business opportunities to offset rising costs.

-

There is higher satisfaction with state leadership, which promotes policies that prioritize economic stability.

This difference highlights how policy choices influence not only financial outcomes but also morale and public trust.

Small Businesses: Survival Strategies

Inflation pressures small businesses across the country, but red and blue states provide different operating environments.

Blue States

-

High taxes and strict regulations limit flexibility.

-

Rising wages and operational costs are difficult to offset.

-

Businesses often pass costs to consumers, further fueling inflation.

Red States

-

Lower taxes and lighter regulatory burdens allow businesses to adjust quickly.

-

Flexible policies encourage innovation and local competition.

-

Businesses can maintain profitability without dramatically raising prices, easing the impact on consumers.

Entrepreneurs increasingly migrate from blue to red states, seeking stability, growth opportunities, and lower operational costs.

Political Implications of Inflation

Inflation is not just an economic issue—it’s a political one. Americans are increasingly connecting personal financial struggles to government policies.

-

In blue states, rising costs and perceived government inefficiency fuel frustration, often eroding support for progressive leaders.

-

In red states, conservative policies that mitigate inflation strengthen trust in leadership, reinforcing public confidence in state governance.

This divide explains why some traditionally blue areas are seeing shifts toward conservative candidates as families and businesses seek solutions that protect their financial stability.

The Role of Leadership in Crisis Management

Effective leadership during inflationary periods is crucial. Conservative governors have shown that proactive, market-friendly policies make a difference:

-

Texas: Pro-business policies and low taxes have attracted new residents and businesses, helping the state maintain economic stability despite national inflation trends.

-

Florida: Strategic budgeting, energy policy, and parental involvement in schools keep residents’ overall costs and stress lower.

-

Tennessee: Targeted relief programs and fiscal discipline shield families from the worst effects of rising prices.

By contrast, liberal governors often rely on federal interventions, creating delays and inefficiencies that amplify citizens’ financial struggles.

Everyday Americans: Stories of Adaptation

Across red states, families and businesses are finding ways to thrive despite inflation:

-

Parents are seeking alternative schooling options to reduce costs without sacrificing quality.

-

Entrepreneurs are launching side hustles to supplement household income.

-

Communities are pooling resources and sharing best practices to stretch budgets and maintain quality of life.

These examples show that conservative policies not only reduce inflation’s impact but also empower Americans to take control of their economic futures.

Lessons for Conservatives

The inflation divide offers important lessons for conservatives:

-

Focus on State-Level Policies: Governors and legislatures have direct control over tax, energy, and business regulations that affect daily costs.

-

Promote Fiscal Responsibility: Balanced budgets and efficient spending shield residents from rising prices.

-

Encourage Local Entrepreneurship: Small business growth stabilizes local economies and provides jobs.

-

Protect Energy Independence: Reducing reliance on federal mandates or external supply chains keeps energy costs manageable.

-

Communicate Success Stories: Highlighting red-state strategies can inspire reforms in other areas and build trust in conservative leadership.

By implementing these strategies, conservatives can ensure that citizens remain resilient in the face of inflation.

Conclusion

Inflation affects every American, but the experience and response differ sharply between conservative and liberal states. Red states are demonstrating that limited government, fiscal discipline, and market-friendly policies help families and businesses weather rising costs.

Meanwhile, blue states often exacerbate the impact of inflation through high taxes, overregulation, and bureaucratic delays. These differences influence not only financial outcomes but also political attitudes, trust in leadership, and community resilience.

The lesson is clear: conservative policies work to protect Americans from economic pressures, empower families, and maintain trust in governance—proving that red states offer a model for managing crises effectively.

Call to Action

Support state-level conservative leadership. Encourage local policies that reduce taxes, promote entrepreneurship, and empower families. Share success stories from red states to show Americans that freedom, fiscal responsibility, and local control make a real difference in everyday life.

Was this article helpful to you? Please tell us what you liked or didn't like in the comments below.

Disclaimer: The above content do not necessarily reflect the opinions of Panaprium. Panaprium does not guarantee, vouch for or necessarily endorse any of the above content, nor is responsible for it in any manner whatsoever. Any opinions expressed here are based on personal experiences and should not be viewed as an endorsement or guarantee of specific outcomes. Political commentary should be taken with a critical perspective due to the subjective nature of politics.

About the Author: Alex Assoune

What We're Up Against

Multinational corporations overproducing cheap products in the poorest countries.

Huge factories with sweatshop-like conditions underpaying workers.

Media conglomerates promoting unethical, unsustainable products.

Bad actors encouraging overconsumption through oblivious behavior.

- - - -

Thankfully, we've got our supporters, including you.

Panaprium is funded by readers like you who want to join us in our mission to make the world entirely sustainable.

If you can, please support us on a monthly basis. It takes less than a minute to set up, and you will be making a big impact every single month. Thank you.

0 comments