In der sich rasant entwickelnden Welt der dezentralen Finanzen (DeFi) gehören DeFi-Aggregatoren zu den oft übersehenen Helden. Insbesondere auf EVM-kompatiblen Blockchains (Ethereum, Arbitrum, Polygon, BNB Chain, Base usw.) ermöglichen diese Plattformen intelligenteres Trading , optimierte Routing-Prozesse und Kosteneinsparungen durch die gleichzeitige Nutzung mehrerer Liquiditätsquellen. Wer regelmäßig Token tauscht oder seine Trades optimieren möchte, für den kann die Wahl des richtigen Aggregators entscheidend sein.

In diesem Artikel gehen wir der Frage nach, was DeFi-Aggregatoren sind , warum sie wichtig sind , stellen einige der besten Plattformen vor und bieten eine übersichtliche Checkliste zur Auswahl der besten Plattform für Ihre Bedürfnisse.

Panaprium ist unabhängig und wird vom Leser unterstützt. Wenn Sie über unseren Link etwas kaufen, erhalten wir möglicherweise eine Provision. Wenn Sie können, unterstützen Sie uns bitte monatlich. Die Einrichtung dauert weniger als eine Minute und Sie werden jeden Monat einen großen Beitrag leisten. Danke schön!

🔍 Was ist ein DeFi-Aggregator?

Ein DeFi-Aggregator ist eine Plattform, die als „Meta-Schnittstelle“ für mehrere dezentrale Börsen (DEXs) und Liquiditätspools fungiert. Anstatt direkt an eine einzelne DEX zu gehen (die möglicherweise begrenzte Liquidität oder höhere Slippage aufweist), kann ein Aggregator Ihre Transaktion auf mehrere Pools verteilen, bei Bedarf Blockchains verbinden und Ihnen den besten Preis oder Ausführungspfad bieten.

Zu den wichtigsten Funktionen gehören:

-

Routing über verschiedene Liquiditätsquellen (AMMs, Orderbuch-DEXs)

-

Cross-Chain- oder Multi-Chain-Swaps (besonders hilfreich in EVM-Ökosystemen)

-

Optimierung für Gasgebühren / Gebühren / Slippage

-

Oftmals werden zusätzliche Funktionen integriert (Wallet-Integration, Gasrückerstattungen, Limit-Orders, einfache Benutzeroberfläche).

Warum das wichtig ist: Auf EVM-Chains sind Gebühren, Slippage und Liquiditätsfragmentierung reale Probleme. Aggregatoren helfen Ihnen, diese zu minimieren, indem sie automatisch den besten Weg finden.

📈 Warum Aggregatoren wichtiger sind

Mehrere Makro- und Ökosystemtrends verstärken derzeit den Wert von Aggregatoren:

-

Mehr Blockchains bedeuten mehr Fragmentierung – Durch die Vielzahl an L1- und L2-Blockchains (Ethereum, BNB Chain, Base, Arbitrum usw.) ist die Liquidität verstreut. Aggregatoren tragen zur Vereinheitlichung des Zugangs bei.

-

Wachsende Token-Auswahl – Die Anzahl der Token und DEXs ist explosionsartig angestiegen; ein manueller Vergleich ist ineffizient.

-

Höhere Erwartungen der Nutzer – Nutzer wünschen sich reibungslose Cross-Chain-Swaps, minimale Gebühren und den besten Preis; Aggregatoren liefern.

-

Anspruchsvolles Routing / MEV-Problematik – Moderne Plattformen optimieren für den MEV (Miner/Extraktor-Wert) und teilen die Transaktionen auf, um Front-Running zu vermeiden.

-

Liquiditätswettbewerb – Bessere Liquidität bedeutet weniger Slippage und bessere Ausführung; Aggregatoren können auf tiefere Pools über DEXs hinweg zugreifen.

Wie eine Analyse feststellt, „erleichtern DEX-Aggregatoren die dezentrale Finanzwelt, indem sie verschiedene Protokolle über eine einzige Schnittstelle zusammenführen.“ ( minddeft.com )

🏆 Die besten EVM-DeFi-Aggregatoren, die Sie in Betracht ziehen sollten

Hier sind einige weit verbreitete Aggregatoren, jeder mit seinen spezifischen Merkmalen:

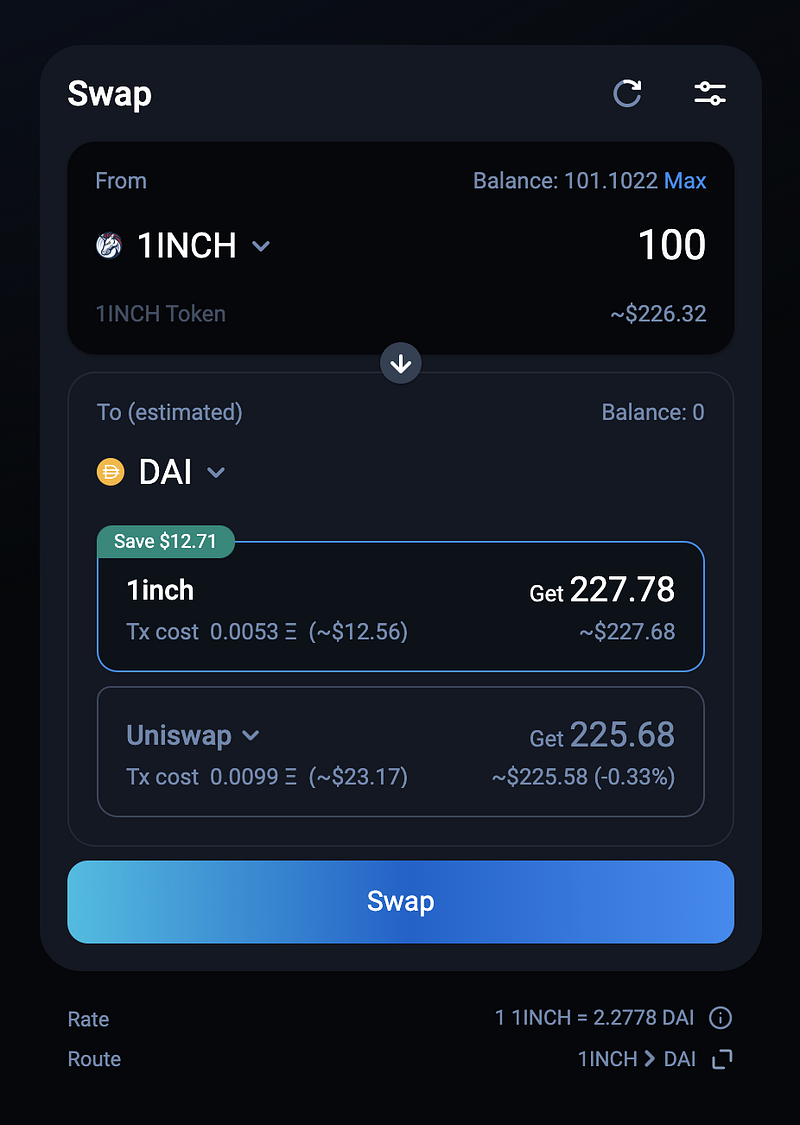

1 Zoll / 1 Zoll

-

Ein erfahrener Aggregator auf Ethereum und mehreren EVM-Chains. Er analysiert die fragmentierte Liquidität eingehend und leitet Trades über zahlreiche Quellen hinweg weiter. ( rubic.exchange )

-

Es unterstützt Limit-Orders, Wallet-Integrationen und verfügt über einen eigenen Token 1INCH für Governance- und Gebührenrabatte.

-

Stärken: Umfassende Unterstützung durch die Lieferkette, ausgereiftes Produkt, gute Benutzererfahrung.

-

Zu beachten ist: Da es sehr bekannt ist, wird es von vielen Nutzern verwendet – manchmal ist der beste Kurs woanders dennoch etwas besser (abhängig vom Token/der Blockchain).

Velora (ehemals ParaSwap)

-

Ein leistungsstarker Aggregator, insbesondere für professionelle Nutzer: effizient, entwicklerfreundlich, unterstützt viele Blockchains. ( rubic.exchange )

-

Transparente Stromführung und starker MEV-Schutz integriert.

-

Stärken: Gut geeignet für Anwender, die Wert auf optimale Handelsausführung und präzise Routing-Details legen.

-

Zu beachten ist: Die Benutzeroberfläche könnte sich eher technisch anfühlen; Gelegenheitsnutzer bevorzugen möglicherweise eine einsteigerfreundlichere Benutzeroberfläche.

Rubic / Rubic

-

Besonders hervorzuheben ist die kettenübergreifende Funktionalität: Es unterstützt mehr als 70 Blockchains und mehr als 360 dezentrale Börsen/Bridges. ( rubic.exchange )

-

Ideal, wenn Sie Token zwischen verschiedenen Blockchains transferieren oder weniger gebräuchliche Blockchains verwenden müssen.

-

Stärken: Breite Kettenunterstützung, zukunftssicher für Cross-Chain-DeFi.

-

Zu beachten ist: Mit der Breite geht Komplexität einher; die Liquidität bei Nischenketten muss weiterhin geprüft werden.

Matcha (0x Protokollschnittstelle)

-

Basiert auf dem 0x-Protokoll; bezieht Liquidität von Dutzenden dezentralen Börsen. Wird außerdem für seine einfache Benutzeroberfläche gelobt. ( rubic.exchange )

-

Gut geeignet für Nutzer, die eine reibungslose Benutzererfahrung und ein ordentliches Routing wünschen.

-

Stärken: Einfache Bedienung, gute zugrundeliegende Routing-Engine.

-

Zu beachten ist: Bei großen oder speziellen Transaktionen bietet dieser Anbieter möglicherweise nicht immer den absolut „besten“ Preis im Vergleich zu einigen professionellen Aggregatoren.

Zapper

-

Mehr als nur ein Swap-Aggregator – auch ein Portfolio-Dashboard und DeFi-Gateway. Wird häufig von Nutzern verwendet, die ihre Vermögenswerte verwalten und an einem Ort handeln möchten. ( minddeft.com )

-

Stärken: All-in-One-Tool (Tausch + Dashboard + Tracking).

-

Zu berücksichtigen ist: Möglicherweise nicht so spezialisiert auf extrem große Transaktionen oder professionelles Routing wie dedizierte Aggregatoren.

🔧 So wählen Sie den richtigen Aggregator für sich aus

Hier ist eine kurze Entscheidungsmatrix, die Ihnen bei der Auswahl hilft:

| Faktor | Was zu überprüfen ist | Warum es wichtig ist |

|---|---|---|

| Kettenhalterung | Auf welchen EVM-Chains handeln Sie (Ethereum, BNB, Base usw.)? | Liquidität und Gebühren variieren je nach Kette |

| Token-Unterstützung und -Tiefe | Funktioniert das Routing Ihres spezifischen Token-Paares durch den Aggregator einwandfrei? | Nischen-Token weisen möglicherweise eine geringe Liquidität auf. |

| Gebühren- und Gasoptimierung | Sind die Strecken treibstoffsparend? Gibt es Gebührenermäßigungen oder sonstige Anreize? | Hohe Benzinpreise schmälern die Gewinne – bessere Routenplanung hilft. |

| Routing-Algorithmus | Wie viele Pools/Quellen durchsucht es? Werden Transaktionen aufgeteilt? | Bessere Ausführung und geringerer Schlupf |

| Benutzeroberfläche und Benutzererfahrung | Anfängerfreundlich vs. Profi-Nutzer | Ihr Wohlbefinden ist wichtig |

| Sicherheits- und Prüfhistorie | Wurde das Projekt geprüft? Wie steht es um seinen Ruf? | Vermeiden Sie Risiken durch Smart Contracts |

| Zusätzliche Funktionen | Limit-Orders, Multi-Hop-Swaps, Cross-Chain-Swaps | Nützlich für fortgeschrittene Handelsaktivitäten |

🧭 Strategie & Anwendungsfälle

-

Kleine, häufige Tauschvorgänge : Wählen Sie einen Aggregator mit niedrigen Gasgebühren und intuitiver Benutzeroberfläche (z. B. Matcha, Zapper).

-

Bei großen oder komplexen Transaktionen : Wählen Sie das beste Routing und minimalen Slippage (1 Inch, ParaSwap).

-

Für Cross-Chain- oder Multi-Hop-Trades : Nutzen Sie einen Aggregator mit breiter Chain-Unterstützung (Rubic).

-

Portfolio-Nutzer : Wenn Sie auch Ihre Gewinne verfolgen/verdienen/Renditen berechnen, wählen Sie einen Toolbox-Aggregator (Zapper).

⚠️ Risiken und Dinge, auf die man achten sollte

-

Liquiditätsrisiko : Selbst mit einem Aggregator kann es bei einigen Token-Paaren zu geringer Liquidität kommen.

-

Slippage / Preisauswirkungen : Routen prüfen und große Transaktionen simulieren.

-

Gas-/Chain-Gebühren : Bei einigen Blockchains (insbesondere im Ethereum-Mainnet) können die Gasgebühren immer noch hoch sein.

-

Risiko durch Smart Contracts : Aggregatoren basieren auf vielen Protokollen – mehr Routing bedeutet eine größere Angriffsfläche.

-

Risiken bei der kettenübergreifenden Überbrückung : Wenn der Aggregator viele Ketten unterstützt, muss sichergestellt werden, dass die Brücken sicher sind.

-

Token-/Projektrisiko : Einige Aggregatoren geben Governance-Token aus; Fokus auf Utility und Tokenomics.

🔮 Zukünftige Trends, die Sie im Auge behalten sollten

-

Stärkere kettenübergreifende Integration : Aggregatoren werden zunehmend nahtlose Transfers über EVM-Ketten hinweg und darüber hinaus unterstützen.

-

Liquiditätsverteilung & Multi-Hop-Optimierung : Automatische Aufteilung von Trades auf verschiedene Chains/Pools für eine optimale Ausführung.

-

Gas- und MEV-Minderung : Mehr integrierte Instrumente zur Reduzierung von Vorabnutzung, Schlupf und versteckten Gebühren.

-

Benutzerfreundliche Oberfläche + Wallet-Integration : DeFi wird auch für technisch nicht versierte Nutzer zugänglich.

-

Aggregator als Ertragsoptimierer : Einige Aggregatoren integrieren Yield Farming- oder Auto-Compounding-Funktionen.

✅ Schlussbetrachtung

Wenn Sie bisher nur eine DEX genutzt oder manuell gehandelt haben, kann der Umstieg auf einen DeFi-Aggregator Ihnen Geld sparen , die Ausführung verbessern und Ihnen Zugang zu mehr Blockchains und Liquidität verschaffen .

Für die meisten Nutzer:

-

Beginnen Sie mit einem vertrauenswürdigen Aggregator wie 1inch oder ParaSwap.

-

Probieren Sie es mit kleinen Transaktionen aus, um Preisgestaltung und Routing zu testen.

-

Sobald Sie sich damit vertraut gemacht haben, können Sie Cross-Chain-Aggregatoren wie Rubic erkunden, falls Sie diese Funktionalität benötigen.

-

Überprüfen Sie stets den Gasverbrauch und den Schlupf und vergewissern Sie sich, dass Sie der Plattform vertrauen.

Mit dem richtigen Tool für Ihren Handelsstil erzielen Sie einen höheren Nutzen aus DeFi – intelligentere Swaps, niedrigere Kosten und eine bessere Ausführung.

War dieser Artikel hilfreich für Sie? Bitte teilen Sie uns in den Kommentaren unten mit, was Ihnen gefallen oder nicht gefallen hat.

Haftungsausschluss: Die oben genannten Inhalte dienen ausschließlich zu Informations- und Bildungszwecken und stellen keine Finanz- oder Anlageberatung dar. Recherchieren Sie stets selbst und ziehen Sie die Beratung durch einen zugelassenen Finanzberater oder Buchhalter in Betracht, bevor Sie finanzielle Entscheidungen treffen. Panaprium übernimmt keine Garantie, Bürgschaft oder Billigung der oben genannten Inhalte und ist in keiner Weise dafür verantwortlich. Alle hier geäußerten Meinungen basieren auf persönlichen Erfahrungen und sollten nicht als Billigung oder Garantie bestimmter Ergebnisse angesehen werden. Investitions- und Finanzentscheidungen bergen Risiken, über die Sie sich im Klaren sein sollten, bevor Sie entscheiden.

About the Author: Alex Assoune

Wogegen Wir Kämpfen

Weltweit-Konzerne produzieren in den ärmsten Ländern im Übermaß billige Produkte.

Fabriken mit Sweatshop-ähnlichen Bedingungen, die die Arbeiter unterbezahlt.

Medienkonglomerate, die unethische, nicht nachhaltige Produkte bewerben.

Schlechte Akteure fördern durch unbewusstes Verhalten den übermäßigen Konsum.

- - - -

Zum Glück haben wir unsere Unterstützer, darunter auch Sie.

Panaprium wird von Lesern wie Ihnen finanziert, die sich unserer Mission anschließen möchten, die Welt völlig umweltfreundlich zu gestalten.

Wenn Sie können, unterstützen Sie uns bitte monatlich. Die Einrichtung dauert weniger als eine Minute und Sie werden jeden Monat einen großen Beitrag leisten. Danke schön.

0 Kommentare